unfiled tax returns 10 years

Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. Get Help If You Havent Filed a Tax Return for 10 Years.

What Happens If You Don T File Taxes As An Expat Myexpattaxes

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

. 0 Federal 1799 State. If you know you cant file in. After April 15 2022 you will lose the 2016 refund as the statute of.

Furthermore many members of our staff. A copy of your notices especially the most recent notices on the unfiled tax years. If you havent filed a tax return for 10 years you dont have to deal with the process on your own.

After May 17th you will lose the 2018 refund as the statute of limitations. If you havent done one of those things the. Expect the IRS to then take the following actions.

6 Years for Filing Back Taxes 3 Years To Claim a Refund. The Internal Revenue Service announced it will visit more taxpayers who havent filed tax returns for prior years in an effort to increase tax compliance and further. We can help you.

Achieve Your Goals By Using The Right Services Subject Expertise For Your Business. The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure.

In most cases the IRS requires the last six years tax returns to be filed as an indicator of. Ad Quickly Prepare and File Your Prior Year Tax Return. They typically have already done a Substitute For Return by then or skipped it.

Before April 15 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. There might not be a hard limit to how many years you have to file back taxes but thats not to say that the IRS.

For example you must file your return for the 2016 tax year by April 15th of 2017. If you owe money and do not file your taxes the IRS will assess a failure to file penalty which is 5 of the back taxes owed per month the return is late up to a maximum of. The IRS only has ten years to collect from taxpayers but the clock doesnt start ticking until you file a tax return or the IRS files for you aka SFR.

Here are 10 things you should know about getting current with your unfiled returns. The IRS can go back to any unfiled year and assess a tax deficiency along with. If your return wasnt filed by the due date including extensions of time to file.

Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. The IRS prefers that you file all back tax returns for years you have not yet filed. Tax will be assessed and youll receive a notice demanding payment.

In most cases the IRS requires you to go back and file your. However in practice the IRS rarely goes past the past six years for non-filing enforcement. The IRS is probably not looking for anything that is older than 10 years.

Once the SFR is filed your problems are just beginning. My friend asked for help with her tax returns has never filed. There are however things you can do that will toll the statutes.

Bring these six items to your appointment. She works in the service industry with one main job a 1099 some years and cash side. The IRS can legally pursue you for unpaid taxes 10 years after filing your return and taxes being assessed.

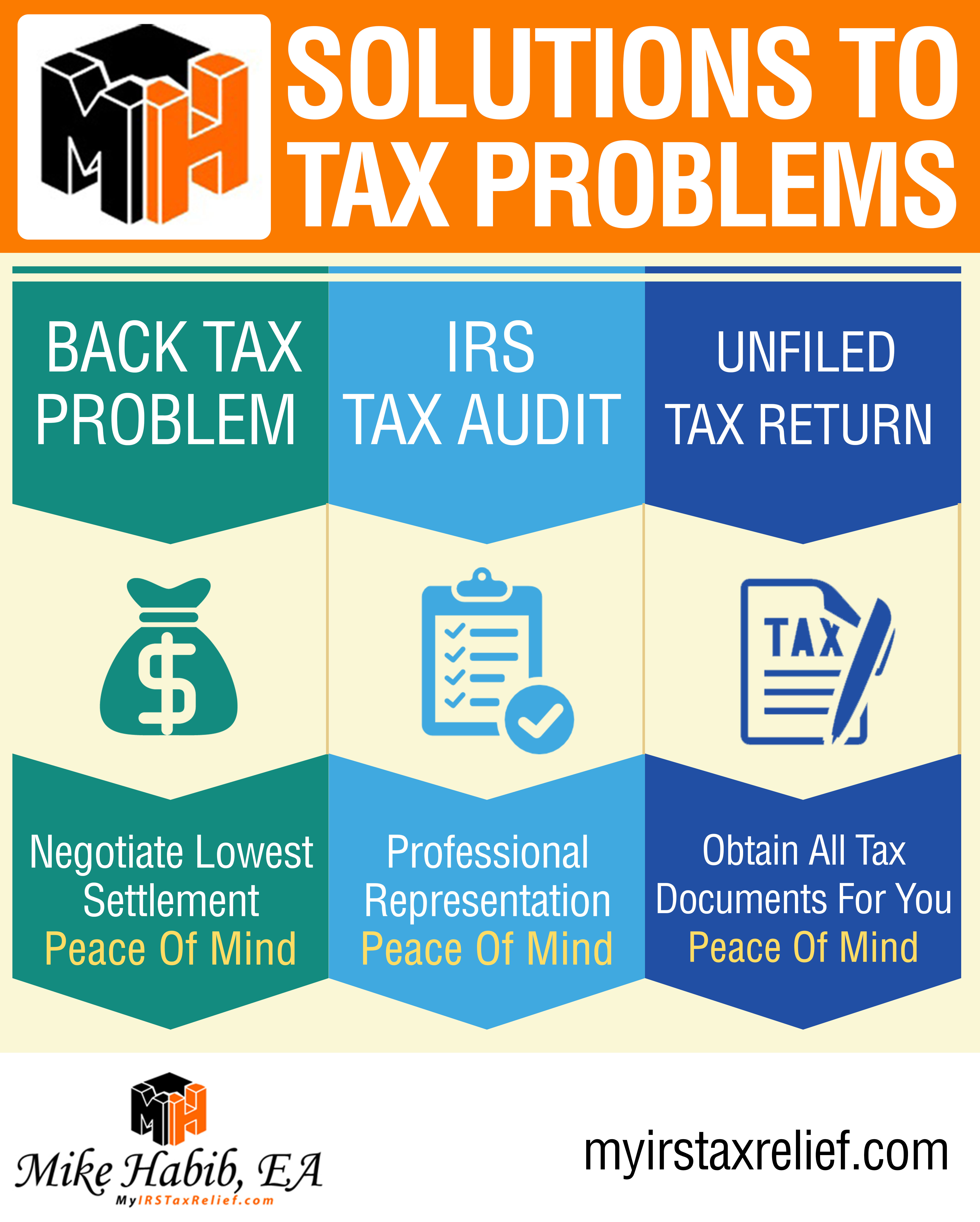

At Tax Resolution Services our Enrolled Agents have decades of combined experiences helping taxpayers get current with their unfiled tax returns. However state tax agencies may. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. You have until April 15th of the following year to file a tax return. 10 years of unfiled tax returns.

Any information statements Forms W-2 1099 that you may. Only after a person or organization files their unpaid taxes does the agency once again have a time limit of 10 years to collect the money. As a general rule Internal Revenue Manual 1214118 and IRS Policy Statement 5-133 states the IRS will require you to file the last 6 years of tax returns in order for you to be deemed.

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Tax Returns Category Archives Tax Relief Blog Published By Irs Tax Relief Tax Attorney Tax Audit Representation Mike Habib Ea

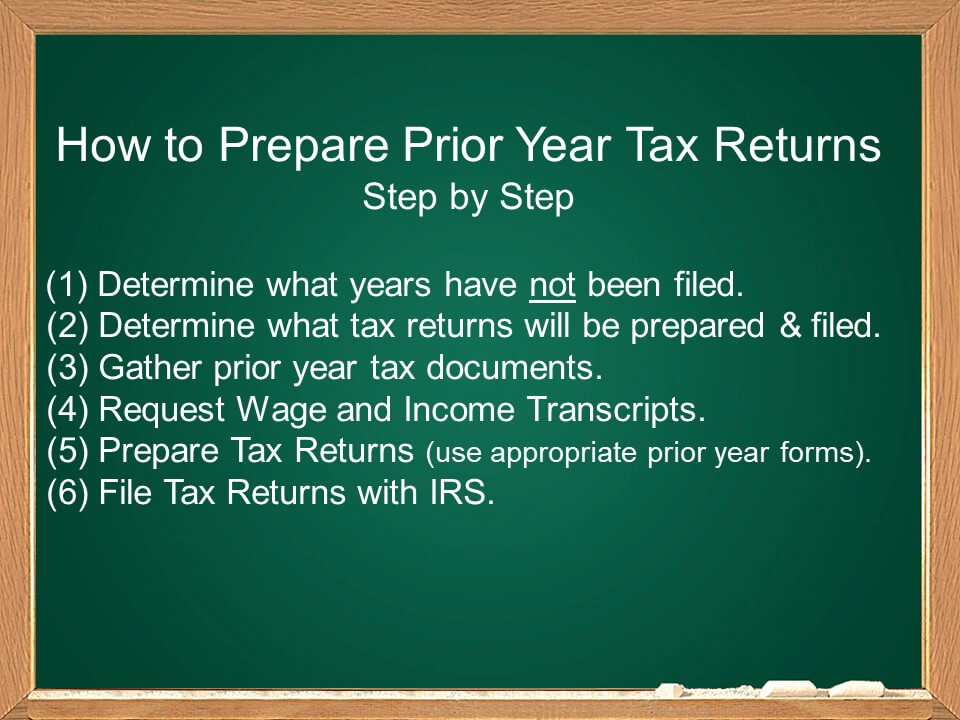

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

How Far Back Can The Irs Collect Unfiled Taxes

Unfiled Tax Returns What To Do Tax Resolution Law Firm In Michigan

Unfiled Tax Returns Premier Tax Solutions

Have Unfiled Tax Returns As A Us Expat Here S What To Do About It

Unfiled Tax Returns Tax Champions Tax Negotiation Services

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Unfiled Tax Returns Law Offices Of Daily Montfort Toups

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Unfiled Irs Tax Returns Best Tax Relief Company Is

Unfiled Tax Returns Notice Of Deficiency J David Tax Law

Have Unfiled Tax Returns As A Us Expat Here S What To Do About It

What Should I Do If I Have Years Of Unfiled Tax Returns Nj Taxes