travel nurse state taxes

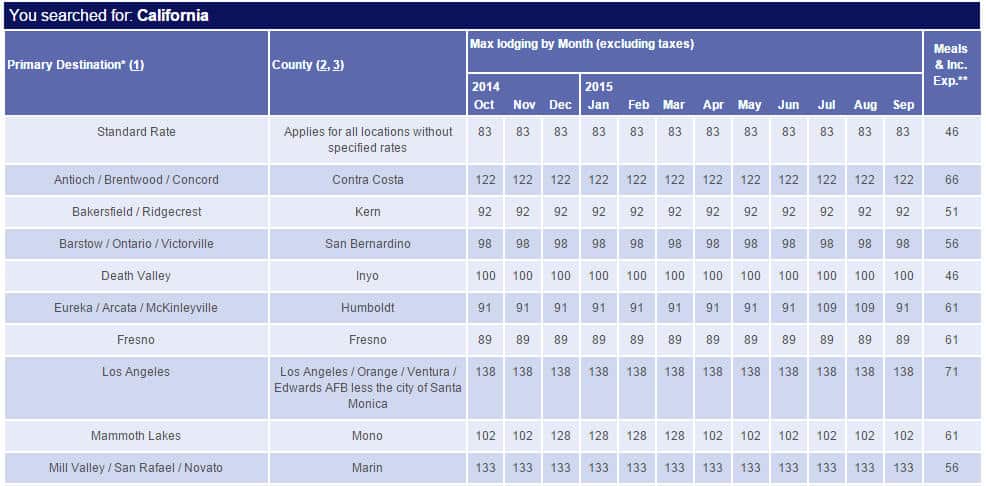

I live in Florida and receive a retirement pension form the. 250 per week for meals and incidentals non-taxable.

Trusted Guide To Travel Nurse Taxes Trusted Health

You can file taxes yourself using IRS e-file or hire a tax professional to file for you.

. 153 in self-employment taxes Social Security and Medicare. 20 per hour taxable base rate that is reported to the IRS. Under the effects of the COVID-19 outbreak the healthcare world is facing unprecedented.

Travel nurse tax tips. First your home state will tax all. Here is an example of a typical pay package.

In this case it is 25720 before taxes or 5495hour. Smith advises travel nurses keep a receipt book to help them make tax preparation a little easier by having. You will owe both state where applicable and federal taxes like everyone else.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. Then add taxed and untaxed. Each state return cannot be prepared in a vacuum as the results on one can be dependent on the other.

There are a handful of important tax advantages to be aware of as a travel nurse primarily in the form of stipends and reimbursements. As a travel nurse you have a unique career experience traveling across the country providing care to patients in needNurses love the freedom flexibility and adventure of becoming a traveling. Hi there I am considering travel nursing to California but I do not know how the state income tax works there.

FREE REVIEW OF PREVIOUSLY FILED TAX. This illustrates that the total value of the contract with taxed and untaxed income. Simply put your tax home is the state where you earn most of your nursing.

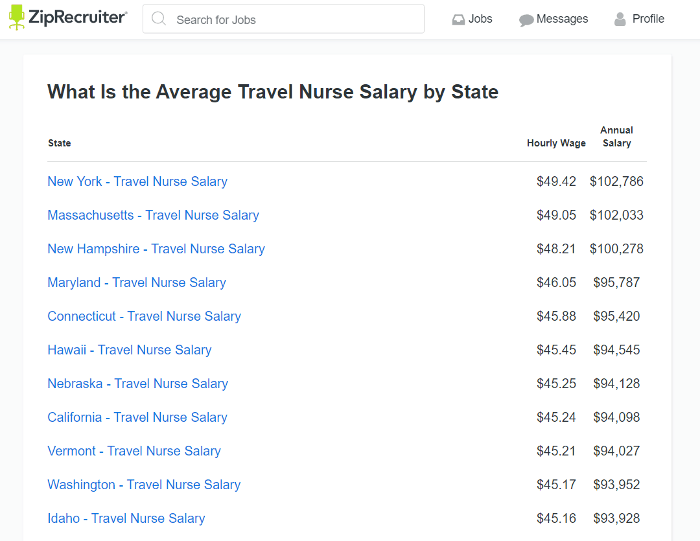

Not just at tax time. File residence tax returns in your home state. For more on how state income tax impacts travel nurse salary seek the advice of a tax professional who is familiar with filing state income taxes for travel healthcare professionals.

Two basic principles are at work here. State travel tax for Travel Nurses. Federal income taxes according to your tax bracket.

One of the primary terms you will hear when filing your taxes as a traveling nurse is tax home. 2020 TAX GUIDE FOR TRAVEL NURSES 2 2020 is a year like weve never seen before. Tax homes tax-free stipends hourly wages bonuses benefits.

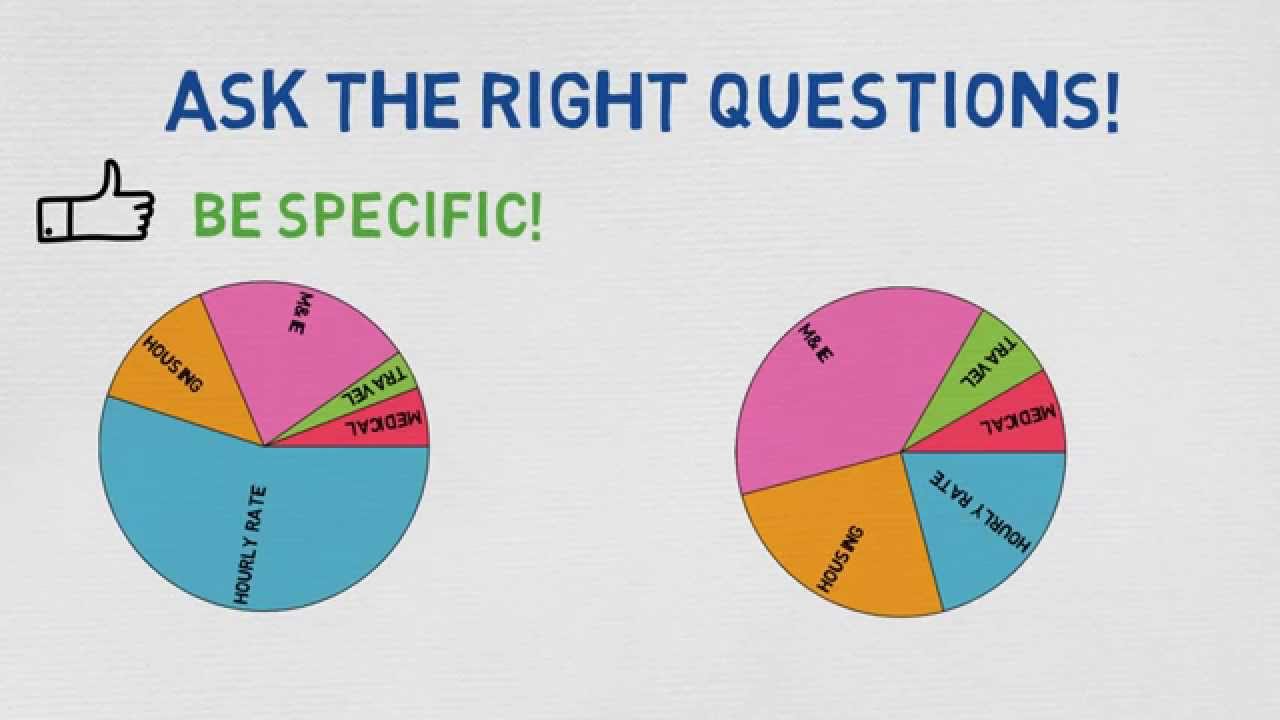

What taxes do travel nurses pay. Deciphering the travel nursing pay structure can be complicated. Travel expenses from your tax home to your work.

The expense of maintaining your tax home. Understanding Travel Nursing Tax Rules. There are at least 4 ways to fill this gap.

Nursing explains that every state has different laws for filing taxes but travel nurses must file a non-resident tax return in every state they have worked in as well as the state thats your permanent tax home. If your home state has a higher tax rate you have a gap to fill. You will need to pay three taxes as an independent contractor.

1 Ask your agency to withholding for your work state AND additional. It is also the most important since the determination of whether per diems. State income taxes for.

Here are some categories of travel nurse tax deductions to be aware of. Either way the faster you file. Tax break 3 Professional expenses.

Tax deductions for travel nurses also include all expenses that are required for your job. This is the most common Tax Questions of Travel Nurses we receive all year. The date to file your taxes by this year is Monday April 18 2022.

How To Calculate Travel Nursing Net Pay Bluepipes Blog

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

Tax Deductions For Nurses Rn Lpn Np More Everlance

6 Things Travel Nurses Should Know About Gsa Rates

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

How To Make The Most Money As A Travel Nurse

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Trusted Event Travel Nurse Taxes 101 Youtube

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurses Are In High Demand Are You Eligible To Travel Travel Nursing Travel Nursing Companies Nurse

State Tax Questions American Traveler

State Tax Questions American Traveler

What Is An Average Housing Stipend For A Travel Nurse Trusted Nurse Staffing